– Land position expanded westward by 73 km2 following discovery of numerous fertile pegmatites –

VANCOUVER, British Columbia, September 27, 2023 - Solstice Gold Corp. (TSXV: SGC) ("Solstice", "we", "our" or the "Company") is pleased to provide an update on the ongoing exploration program at its Stewart Lake Project ("SLP") in the English River Subprovince ("ERS"), approximately 275 km NNE of Thunder Bay, Ontario. The Company also recently added 73 km2 to the western margin of the SLP, increasing its ERS land package to 268 km2, following discovery of extensive pegmatites with fertile mineralogy. Approximately 65% of the property has been evaluated at a reconnaissance scale. Field programs will continue until October while weather conditions permit.

Key 2023 exploration details:

- Fertile indicators have been identified in pegmatites and sampled in all areas of the project explored to date over the course of the ongoing 2023 field season. The majority of the areas identified in satellite photo analysis have abundant pegmatites.

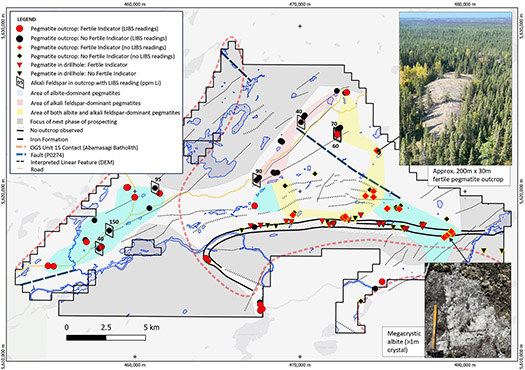

- Pegmatite thicknesses vary from meter-scale up to over 30m thick, with several pegmatites exceeding 25m. One 30m-thick pegmatite crosscuts English River metasediments and has a strike length of at least 200m (photo inset, Figure 1).

- Abundant fertile indicator minerals have been identified in pegmatites, containing one or more of muscovite, garnet, tourmaline, cordierite, and a widespread unidentified blue-green mineral (Figure 1).

- Large areas of pegmatite with 30 to 50 cm feldspar crystals and locally meter-scale crystals of albite1 (photo inset, Figure 1) were identified.

- Preliminary and ongoing geochemical analysis using LIBS2 has identified a lithium-enriched trend of over 40ppm Li in alkali feldspars (40 – 150ppm), which will require more follow-up prospecting and analysis. Similar readings in alkali feldspars have been shown to be reliable indicators for the presence of spodumene in known lithium districts3,4.

Ongoing work will expand reconnaissance prospecting in currently unexplored areas of the project and will also include detailed follow up in priority areas based on observations and results to date.

Pablo McDonald, Solstice CEO stated, "I am very pleased with the interim results of our exploration program. Our team's work so far shows that we are indeed in a newly identified area of prospective pegmatites. This positive first pass has already generated several promising geochemical and mineralogical anomalies that will be the focus of our follow-up efforts. We now are on the vanguard of lithium exploration in the ERS; we have the largest land package in the ERS and based on the new recognition of widespread fertile pegmatites from our reconnaissance-scale work to date, we consider the potential for LCT pegmatites to be high."

The Company plans to extend its in-depth and systematic prospecting and sampling program throughout the fall. Key areas that have not been prospected will be systematically explored (see Figure 1).

The Company also acknowledges the support of the Ontario Government with a $200,000 grant through their Ontario Junior Exploration Program. Pursuant to the OJEP grant, Solstice will receive up to $200,000 to cover 50% of eligible exploration costs on the project, which represents a meaningful milestone in advancing exploration at SLP.

Background

Solstice acquired its extensive land position in February 2023. The project area is previously unexplored and was acquired for rare element pegmatite exploration based on its geological similarity to the Quetico Subprovince (fertile granites in a dominantly metasedimentary setting), located to the south which hosts several rare element pegmatite deposits, as well as the presence of approximately 150 pegmatites up to 28m thick (core length) in drill core in a small part of the project area which was explored in the late 1950's to early 1960's for iron mineralization (Figure 1). In addition, the OGS recommended the area for exploration in February 2023 also based on general similarities with the Quetico geological Subprovince and a beryl-bearing pegmatite located to the east of Solstice's claims. Visit our website for a detailed background on fertile mineralogy and LCT potential of the area.

1 Field identification is of albite. X-ray diffraction is required for definitive characterization of the mineral

2 LIBS (laser-induced breakdown spectroscopy) using a Sci-Labs Z-300 analyzer. Lithium data calibrated against LCT pegmatite standard GTA-06. Data should be considered semi-quantitative pending confirmation by other analytical techniques.

3 Maneta, V. and Baker, R.vThe potential of lithium in alkali feldspars, quartz, and muscovite as a geochemical indicator in the exploration for lithium-rich granitic pegmatites: A case study from the spodumene-rich Moblan pegmatite, Quebec, Canada, Journal of Geochemical Exploration, Volume 205, 2019, 106336, ISSN 0375-6742, https://doi.org/10.1016/j.gexplo.2019.106336.

4 Morozova,L. et al. Distribution of Trace Elements in K-Feldspar with Implications for Tracing Ore-Forming Processes in Pegmatites: Examples from the World-Class Kolmozero Lithium Deposit, NW Russia. Minerals 2022, 12, 1448. https://doi.org/10.3390/min12111448

Figure 1: SLP Property outline showing sampled and historically drilled pegmatites with fertile indicators

Warrant Amendments

The Company announces that, further to its news release dated August 10, 2023, it intends to amend an aggregate of 15,411,930 warrants exercisable for common shares (the "Common Shares") issued pursuant to a private placement on August 30, 2022 (the "August 2022 Warrants") (the Company had originally disclosed it intended to amend 14,041,941 August 2022 Warrants). The August 2022 Warrants have an exercise price of $0.17 and expire on February 29, 2024. The Company intends to: (i) reduce the exercise price of the August 2022 Warrants to $0.08; and (ii) include an accelerated expiry clause that will reduce the expiry period of the August 2022 Warrants to 30 days (the "Accelerated Expiry Period") if for any ten consecutive trading days of Common Shares (the "Premium Trading Days") the closing price exceeds the exercise price of the August 2022 Warrants by 25% or more, which would be $0.10, whereby such Accelerated Expiry Period will begin not more than 7 calendar days after the tenth Premium Trading Day.

An aggregate of 17,120,274 August 2022 Warrants were issued, however in compliance with the policies of the TSX Venture Exchange (the "TSXV"), 15,411,930 August 2022 Warrants are being amended, comprising of: (i) 1,712,026 August 2022 Warrants held by directors, officers and control persons of the Company; and (ii) all other August 2022 Warrants (being 13,699,904 August 2022 Warrants). Amendment of the August 2022 Warrants has been approved by all holders of the August 2022 Warrants and is subject to the approval of the TSXV.

The anticipated amendments to 1,712,026 August 2022 Warrants held by certain directors, officers and other related parties of the Company constitute "related party transactions" of the Company under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). In addition, certain directors, officers and other related parties of the Company purchased units of the Company in the private placement financing of the Company that closed on August 10, 2023 (the "Offering"). The purchase of units under the Offering by such directors, officers and other related parties of the Company are considered "connected transactions" to the amendments to 1,712,026 August 2022 Warrants held by certain directors, officers and other related parties of the Company under MI 61-101.

Pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101, the Company is exempt from obtaining formal valuation and minority approval of the Company's shareholders with respect to the "related party transactions" and "connected transactions", as the fair market value of the August 2022 Warrants held by related parties being amended and the fair market value of securities purchased by related parties under the Offering is below 25% of the Company's market capitalization as determined in accordance with MI 61-101.

About Solstice Gold Corp.

Solstice is an exploration company with quality, district-scale gold and lithium projects in established mining regions of Canada. Our 268 km2 SLP lithium property is located in the English River Subprovince in an area that has recently garnered significant interest for its potential to host rare metals. Our 194 km2 Red Lake Extension (RLX) and New Frontier projects are located at the northwestern extension of the prolific Red Lake Camp in Ontario and approximately 45 km from the Red Lake Mine Complex owned by Evolution Mining. Our 322 km2 Atikokan Gold Project is approximately 23 km from the Hammond Reef Gold Project owned by Agnico Eagle Mines Limited. Our Qaiqtuq Gold Project which covers 886 km2 with certain other rights covering an adjacent 683 km2, hosts a 10 km2 high grade gold boulder field, is fully permitted and hosts multiple drill-ready targets. Qaiqtuq is located in Nunavut, only 26 km from Rankin Inlet and approximately 7 km from the Meliadine Gold Mine owned by Agnico Eagle Mines Limited. An extensive gold and battery metal royalty and property portfolio of over 80 assets was purchased in October 2021. Over $2 million in value and three new royalties have been generated since the acquisition.

Solstice is committed to responsible exploration and development in the communities in which we work. For more details on Solstice Gold, our exploration projects and details on our recently acquired portfolio of projects please see our Corporate Presentation available at www.solsticegold.com.

Solstice's Chairman, David Adamson, was a co-award winner for the discovery of Battle North Gold Corporation's Bateman Gold deposit and was instrumental in the acquisition of many of the district properties in the Battle North portfolio during his successful 16 years of exploration in the Red Lake.

Sandy Barham, M.Sc., P.Geo., Senior Geologist, is the Qualified Person as defined by NI 43-101 standards responsible for reviewing and approving the technical disclosures of this news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

On Behalf of Solstice Gold Corp.

Pablo McDonald, Chief Executive Officer

For further information on Solstice Gold Corp., please visit our website at www.solsticegold.com or contact:

Phone: (604) 283-7234

info@solsticegold.com

Forward-Looking Statements and Additional Cautionary Language

This news release contains certain forward-looking statements ("FLS") including, but not limited to rare metal pegmatites prospectively, the need for more prospecting and analysis, reconnaissance prospecting in currently unexplored areas of the project, the focus of follow-up efforts on promising geochemical and mineralogical anomalies, the potential for LCT pegmatites to be high, extension of in-depth systematic prospecting and sampling program in the fall, the Company's intention to amend the August 2022 Warrants and the required approval of the TSXV. FLS can often be identified by forward-looking words such as "approximate or (~)", "emerging", "goal", "plan", "intent", "estimate", "expects", "potential", "scheduled", "may" and "will" or similar words suggesting future outcomes or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. In respect of the FLS, the Company has made certain assumptions that management believes are reasonable at this time. The assumptions include that the Company will have sufficient financial resources for fall sampling and prospecting, that pegmatite discoveries will be to the level anticipated and that the TSXV will approve the amendments to the August 2022 Warrants however, there can be no assurance that such assumptions and statements will prove to be accurate and actual results could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from any FLS include, but are not limited to, limited capital or access to additional capital for prospecting, delays in obtaining or failures to obtain required TSXV, governmental, environmental or other project approvals, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, regulatory approvals and other factors. FLS are subject to risks, uncertainties and other factors that could cause actual results to differ materially from expected results.

Potential shareholders and prospective investors should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the FLS. Shareholders are cautioned not to place undue reliance on FLS. By their nature FLS involve numerous assumptions, inherent risks and uncertainties, both general and specific that contribute to the possibility that the predictions, forecasts, projections and various future events will not occur. Solstice undertakes no obligation to update publicly or otherwise revise any FLS whether as a result of new information, future events or other such factors which affect this information, except as required by law.